Haven Protocol's XHV - the Digital Means of Production

Somewhere in 2020 I first read about this innovative project called Haven Protocol. I wanted to write down my thoughts about Haven Protocol and its XHV, so I did. I hope you enjoy! :)

TL;DR

If the number of use cases for Haven Protocol’s xAssets increases over the coming years, it is very likely that the demand for xAssets will increase too. The combined value of all currently existing xAssets is only around USD 1m, this means a lot of new xAssets will have to be produced to meet the increased demand while simultaneously there will probably be fewer and fewer reasons to convert xAssets back to XHV. And as burning the supply of XHV is the only way to produce (mint) new xAssets, XHV has a high chance of becoming a very scarce digital resource in the new category of digital assets-means of production and thus offers enormous price-growth potential.

The Means of Production

The means of production, as in, all resources that are needed to produce a certain good or service, are of paramount importance for human civilization.

Examples of means of production can be: capital, labor, tools, machines, land, commodities, raw materials, knowledge and so on.

The means of production are needed to produce the goods and services human civilization needs and wants.

This is probably also why, historically, and also evident today, owning the means of production gave and gives people enormous wealth and often also power.

The New Means of Production

If you look at humanity’s history, you can recognize that the means of production and/or the relevance of certain resources change over time. Some resources gain relevance and some loose it partially or even completely - and also, completely new ones emerge and gain a lot of relevance.

A recent example of a new kind of means of production of high importance is data.

Mainly boosted through the rise of the internet, data quickly became a very valuable and useful resource.

And right now, we can witness the emergence of a new means of production category pushed by the rise of web3 - digital assets.

One example is Ether. Ether is needed to make transactions on the Ethereum blockchain and since EIP-1559 this digital resource’s properties have changed from slightly inflationary to potentially deflationary or in other words from already scarce to even way scarcer.

Of course there are many digital assets with different properties but in this article, I would like to dive a bit deeper in one of the most interesting in my eyes:

Enter Haven Protocol and its XHV Token

Haven Protocol is in my opinion one of the most innovative and exciting projects in the web3 space. Here I don’t want to dive into the technical side or details of Haven Protocol too deep but rather want to go more into what it is and its potential.

With nothing more than access to the internet, Haven Protocol enables you to get access to a personal account (Vault) with which you can store, convert, send, and receive theoretically every kind of (synthetic) asset. And, as if this was not enough, all these actions are protected by Monero-grade privacy.

At the time of writing, next to its native XHV token, Haven Protocol supports 9 so called xAssets which you can use in your Haven Vault and which keep their value pegged to the underlying asset’s value. (synthetic assets) This means you can currently hold private US Dollar, Euro, British Pound, Swiss Franc, Australian Dollar, Chinese Yuan, Bitcoin, Silver, and Gold in your Haven Vault and for this, the only thing you need is access to the internet. Theoretically the Haven Protocol could support many more xAssets (for example also stocks, commodities etc.) in the future as new ones can and probably will be added over time.

The Haven Protocol team and its community don’t stop there. There is a lot of work in progress. The team does a lot to improve the liquidity and use cases of XHV and all xAssets through e.g. new listings on decentralized exchanges (DEXs) and centralized exchanges (CEXs). Also topics like wrapping of XHV and xAssets to get wrapped versions of them on the Ethereum blockchain to enable for example DeFi use cases start to pick up traction.

If you pay attention you can recognize that Haven Protocol does not aim at simply providing a wallet in which you can store assets - much more it aims at becoming a big thriving ecosystem of assets with built in privacy which has the potential to greatly provide value for the humanity of the future.

XHV, the Scarce Digital Resource

But what does this have to do with means of production right? Well, that’s the point where it gets interesting. Did you already ask yourself where these awesome xAssets come from? In simple terms, they don’t exist yet and have to be produced (minted) by burning Haven Protocol’s native token XHV. The same also works the other way around, by burning xAssets you can create (mint) new XHV. To learn more about how the conversion process works please take a look at Haven Protocol Knowledge Base Conversion Rates.

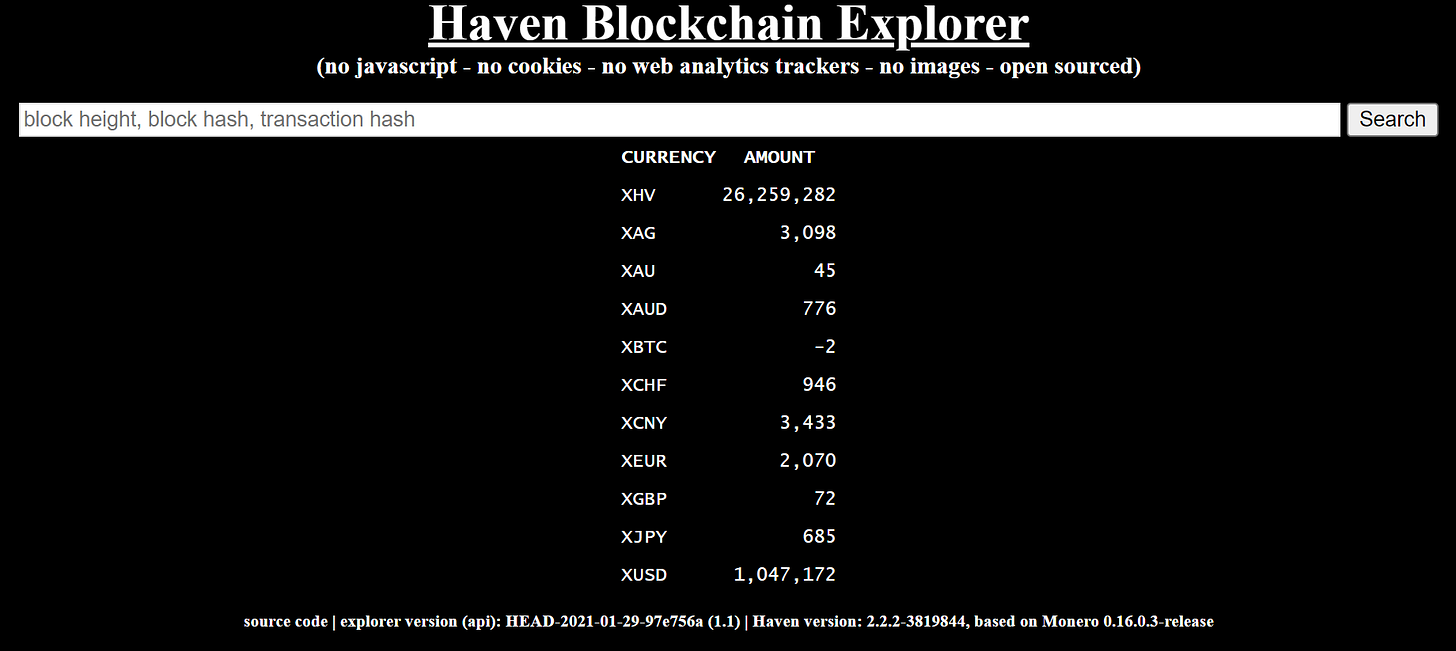

At the time of writing, the supply of XHV is ~26.26m and the value of all xAssets in the Haven Protocol ecosystem combined is around USD 1m. (sources: havex.io and Haven Blockchain Explorer)

This means, in other words, that XHV is a digital resource needed to produce xAssets.

Because of the mint and burn process, XHV has a dynamic supply. (it also has slight inflation due to mining)

There might be many more use cases and a lot of liquidity for xAssets in the future, and in this case we could assume the whole xAssets ecosystem might grow exponentially over the coming years and all xAssets combined thus have the potential to reach a value of several hundred billions or even trillions of USD. And because of the many use cases and the improved liquidity, there will probably mostly be no reason to convert these xAssets back to XHV. (path of least resistance)

Now if you consider that the value of all xAssets combined currently is only around USD 1m and to reach a xAssets market cap in the billions to trillions, you might come to the conclusion that the biggest part of the XHV supply will have to get burned to produce all these xAssets. This would lead to XHV becoming an extremely scarce digital resource in the future.

I really believe that the whole Haven Protocol ecosystem can become extremely big in the future, because of this I think I have never seen a token or asset in general which has as much price-growth potential, due to tokenomics alone, as XHV.

XHV has the potential to become the scarcest and highest priced digital resource and stand out as one of the most interesting digital assets in this new means of production category.

Theoretical Example Scenarios

To show you the extent to which the price of 1 XHV could increase over the coming years if the Haven Protocol ecosystem grows as described, I would like to show you 3 theoretical example scenarios for the coming 5 years. The model I’ve made to calculate these scenarios is pretty simple and is not intended to give exact predictions but simply to show the theoretical growth potential of the price of XHV under different circumstances.

For these scenarios the model assumes the xAssets ecosystem (xAssets TVL) grows steadily, exponentially to USD ~100b over the next 5 years while the XHV market cap grows to either ~1/3, ~1/1, or ~3/1 of the xAssets TVL over the same time period.

(The model does all the calculation on an hourly basis over 5 years, XHV to xAsset conversions are based on the XHV 24h MA price)

Starting values for all scenarios, based on values at time of writing:

xAssets TVL: USD 1’061’000

XHV market cap: USD 126’187’200

XHV spot price: USD 4.80

XHV supply: USD 26’289’000

Example Scenario 1

Over the next 5 years xAssets TVL grows steadily to USD ~100b at a CAGR of ~888.23% and XHV market cap grows to USD ~33.33b at a CAGR of ~205.05%.

End values:

XHV spot price: USD 447'769.89

XHV supply: 74'443 (26’214’557 burned)

XHV burn per hour: 59 (average: 598.51/h)

Example Scenario 2

Over the next 5 years xAssets TVL grows steadily to USD ~100b at a CAGR of ~888.23% and XHV market cap grows to USD ~100b at a CAGR of ~280.01%.

End values:

XHV spot price: USD 41'301.15

XHV supply: 2'421'251 (23’867’749 burned)

XHV burn per hour: 636 (average: 544.93/h)

Example Scenario 3

Over the next 5 years xAssets TVL grows steadily to USD ~100b at a CAGR of ~888.23% and XHV market cap grows to USD ~300b at a CAGR of ~373.4%.

End values:

XHV spot price: USD 31'458.24

XHV supply: 9'536'822 (16’752’178 burned)

XHV burn per hour: 834 (average: 382.47/h)

Conclusion for these examples

As you can see, the values calculated based on this model can differ a lot for different circumstances. How much of the XHV supply will be left after such a growth period will depend on the rate (price) at which XHV will be burned to support the growth of the xAsset ecosystem. For example, if the price of XHV rises faster than the xAssets TVL in the beginning, less XHV will have to be burned to grow the xAssets TVL and thus there will be more of the XHV supply left in the end and vice versa. Due to this the price of 1 XHV and its remaining supply after such a growth period could vary widely. And please also keep in mind that the supply of XHV is dynamic (minting XHV=inflation/burning XHV=deflation) and this model only shows steady xAssets TVL growth. (only XHV→xAsset conversions, no xAsset→XHV conversions)

This is of course just a model and the reality could look very different.

Of course I’m interested in your opinion or thoughts and please also feel free to give critical feedback or to correct me if I got something wrong, thanks for reading!

My Twitter: twitter.com/InnoTraveler

PS: good luck with seizing the means of production of the xChads ;)

Nothing in this article is financial advice or advice in any other form.

I do not give any guarantee for the correctness of what is stated in this article. DYOR!